Exploring all options

- 02.26.24

- Markets & Investing

- Commentary

Rob Tayloe discusses fixed income market conditions and offers insight for bond investors.

When it comes to making decisions in our daily lives, most of us stick to a certain way of doing things. If we are conditioned to take the same route, we always do to get from point A to point B, that is typically how we proceed. Imagine if there was a new road built that would cut our drive time by 5 minutes. We need to consider this to optimize our results. The same is true for our investments. We need to weigh all the options available and proceed with the investment that allows the highest after-tax return while staying within the risk profile of that situation.

We must realize that spreads are not constant. Each situation must determine how many basis points is it worth to buy an A-rated bond vs. a BBB-rated bond. As you can see in the graph below, the current spread between 7-year A and BBB-rated corporate bonds is at a 12-month low:

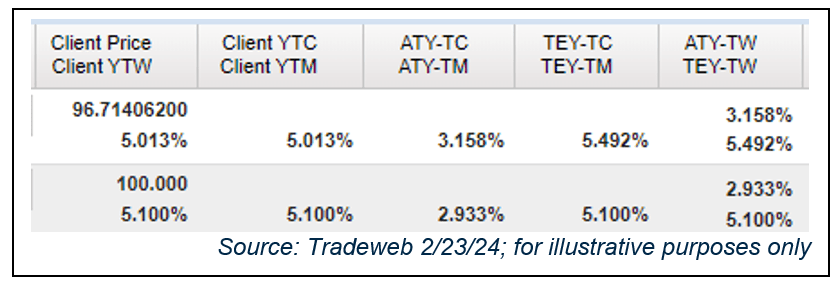

p>The current spread sits just north of 43 basis points. The high was 69 basis points back on 5/10/23 and the mean over the last year is 57 basis points. The investor needs to determine what that spread is worth. Some may find BBB credits that they feel more comfortable with regardless of yield and other investors may prefer to stick with A-rated names.It is also important to know the taxation features of individual bonds. For example, Treasuries are exempt from state income taxes, so those accounts housed in states with an income tax will benefit from this feature. The same is true for buying municipal bonds in the state of residence. Investors who are looking for short-term strategies usually decide between CDs and Treasuries. Below, you can see a 1yr CD compared with a 1yr Treasury:

The top is a Treasury, and the bottom is a CD. Without taking the state income tax into account, the CD would yield almost 9 basis points more than the Treasury. However, if you look at the middle column, you can see that the Treasury is higher by over 22 basis points on an after-tax basis using Georgia (5.49% state income tax) as the state of residence.

There are a multitude of similar situations that we could create here, but the point is that based on your individual goals and needs, you should look at each opportunity and get the best bang for the buck.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.